CLARITY – CONNECTION – COMMUNITY

IS AN ADVISORY BOUTIQUE THAT SINCE 2011 HAS BEEN A GO-TO SOURCE OF WORLD-CLASS MACRO ANALYSIS & OUTSTANDING COMMUNITY EVENTS.

In the maelstrom of events engulfing today’s world, getting the clarity to make good decisions is tough. By connecting the dots through our macro prism, we eschew silo-thinking to offer you a unique mix of first-in-class macro analysis straight to your inbox and exclusive access to an exceptional global network thanks to a calendar of world-class Summits of Minds. All this to give you a better grasp of what matters, what’s coming next and why nature and wellbeing are vital for good decision making.

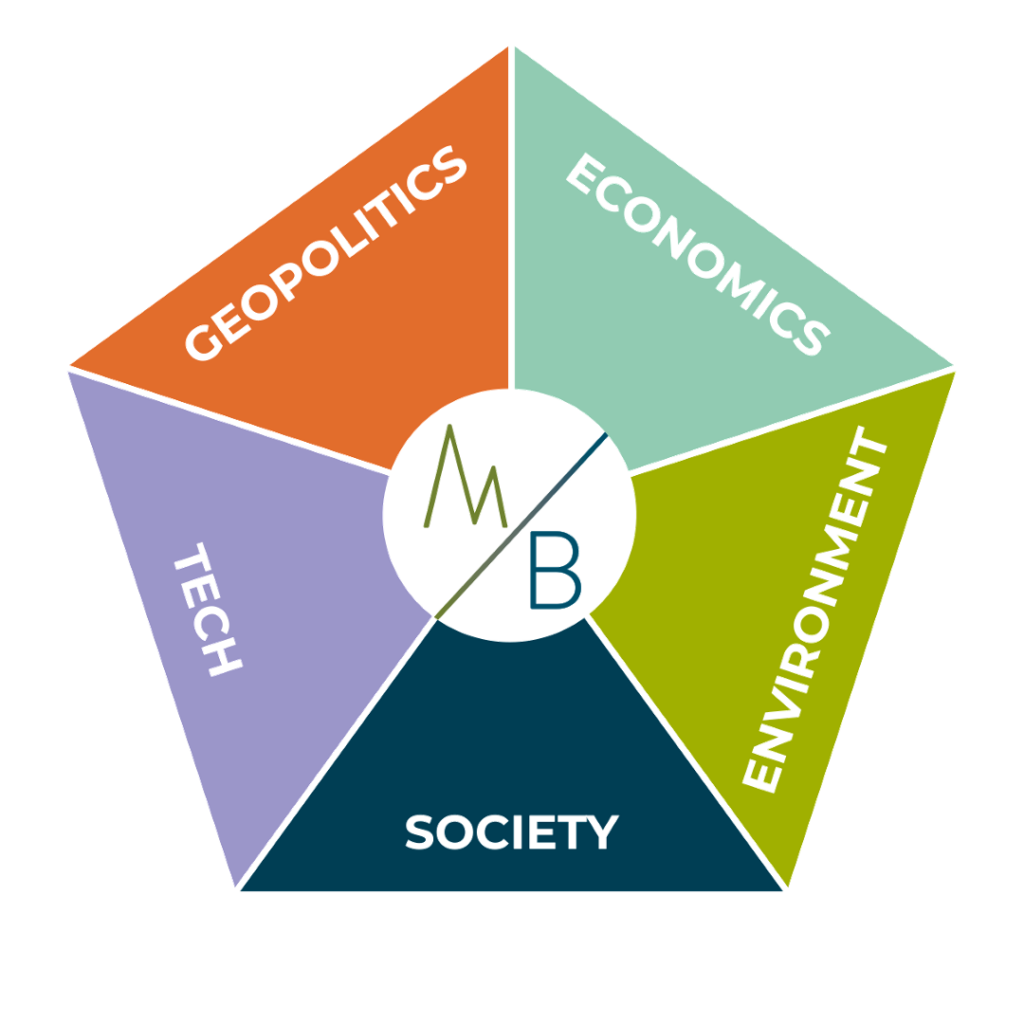

NOT A CRYSTAL BALL…

BUT A USEFUL PRISM TO AVOID SILO THINKING & TO MAKE BETTER DECISIONS